The article below is the last in a series designed to give readers insight into the school finance system in Texas. School finance is complicated. But it matters because it affects everything: student learning, teacher pay, school facilities, security, school buses, computers, career and technical opportunities, internet access, sports, fine arts and on and on and on. Ultimately, it affects the future of Texas.

Each article in the series bites off a small piece of school finance and attempts to give readers a basic understanding of the system in Texas and Arlington ISD.

State will recapture about $5 billion this year

Robin Hood stole from the rich to give to the poor.

That’s not exactly what happens in Texas when the state takes money from school districts, but Robin Hood is the name some have given the practice.

The system is now more commonly known as recapture. The Texas Education Agency (TEA) calls it Excess Local Revenue. No matter what you call it, it nets the state billions of dollars every year – billions Texans paid in local property taxes.

Texas’ recapture system started in 1993, conceived to address the problem of unequal funding for schools across the state. The inequity came from the disparity in local tax revenue – the primary source for school funding.

School districts do not collect the same amount of tax revenue because districts are not equal in property value. Some are very “rich” – with high property values – and some are “poor” – with much lower property values. Or one school district may have more properties to tax than another school district.

The higher the property values in a district or the more properties in a district, the greater the tax revenue collected in that district. The “richer” property districts inevitably collect more in tax revenue than the “poorer” property districts.

So, recapture was introduced to equalize funding across the state and make sure all districts have about the same amount of money to spend per student regardless of their tax revenue.

According to TEA, “This section of the Texas Education Code (TEC) makes provisions for certain school districts to share their local tax revenue with other school districts… recaptured funds are redistributed by the school finance system to assist with the financing of public education for all school districts.”

So, take from the wealthy and give to the poor. Kind of like Robin Hood. Only it’s not quite that cut and dry.

How much does the state take?

The “certain school districts” that Texas recaptures funds from are those deemed “property wealthy.”

So, how much does the state take? Recall from the article on the basic allotment that the state allows school districts to receive an allotment for each student – a certain amount of money for each student. The basic allotment for each student established by the state in 2019 is $6,160 – but that number can grow depending on certain demographics or student characteristics (like qualifying for special education or attending a career tech class.)

The money for that allotment can come from two sources – local property taxes and state aid. Whatever portion of the allotment – the $6,160 per student – that is not covered by local property taxes, the state will cover. So, if local property taxes raised enough to cover $5,000 per student, the state would kick in an extra $1,160 per student.

It’s a way to guarantee that every school district – whether property rich or property poor – receives the same amount of money per student.

But what if a school district raises more money in tax revenue than the allotment? Like if a district brought in $6,500 per student, which would be $340 more than the state allots.

This is where recapture comes in. That district is considered property wealthy, and the state takes the “excess.” It would take that extra $340 in this example. The state then uses the “excess” to meet its financial education obligations elsewhere.

To be clear, the excess does not mean “poor” school districts get more money. All districts, no matter their wealth level, are guaranteed the same amount. But the state does use the recaptured money to fill in the allotment gap for the “poorer” districts unable to collect enough in property taxes to cover the allotment per student. It also helps fund charter schools, which have no property tax revenue and are 100% state funded.

Arlington ISD is a recapture district

When recapture started in 1994, the state collected $127 million from 34 “property wealthy” districts. But the program has grown considerably since. By 2021, Texas recaptured nearly $3 billion from 158 school districts and is projected to collect about $5 billion in 2025 from a growing number of districts.

And Arlington ISD is one of them.

Does that mean that Arlington ISD is “rich?”

Judging by the student population in the district, the answer is no. About 75% of Arlington ISD students are low-income, qualifying for free or reduced lunch.

But the Arlington ISD area does have high property values, which have been increasing in recent years. At the same time, Arlington ISD’s enrollment has been decreasing over the last several years. That means when Arlington ISD collects tax revenue, it’s averaging more revenue per student each year. And it now collects more than the state’s designated allotment per child.

But the Arlington ISD area does have high property values, which have been increasing in recent years. At the same time, Arlington ISD’s enrollment has been decreasing over the last several years. That means when Arlington ISD collects tax revenue, it’s averaging more revenue per student each year. And it now collects more than the state’s designated allotment per child.

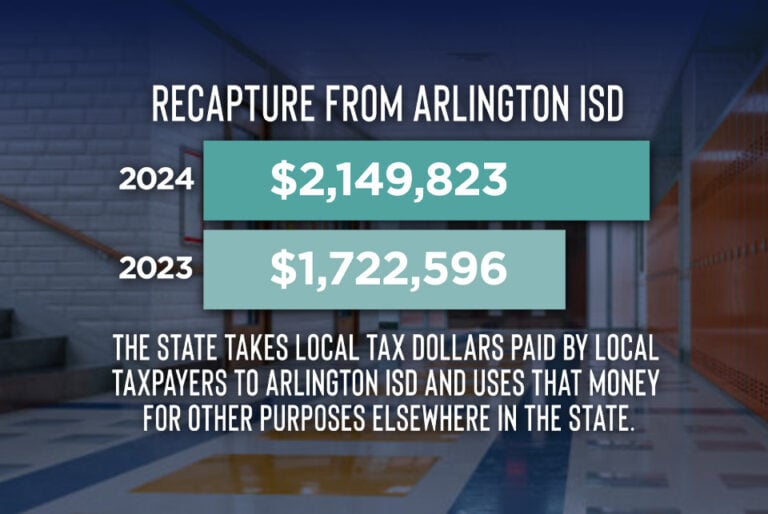

So, Arlington ISD became a recapture district in recent years. In 2023, Arlington ISD sent $1,722,598 to the state, and in 2024, the district sent $2,149,823 to the state. The latest current year amended budget as of March 13, 2025, has approximately $4 million budgeted for recapture.

Perhaps not exactly what Robin Hood had in mind when he stole from Prince John.

Did you miss any of the other articles in this series on school finance? You can still read them by clicking on the links below:

- School finance in Texas is complicated

- Where do school districts get their money?

- Learn about school property taxes in Arlington ISD

- School funding starts with the basic allotment

- Public school funding in Texas is based on attendance

- Why do school districts need bonds?

- What does it cost to educate a student?

- Arlington ISD is a recapture district