What is a Voter-Approval Tax Rate Election or VATRE?

State law requires that school districts seek voter approval to raise their tax rate above a prescribed amount. The election is referred to as a Voter-Approval Tax Rate Election (VATRE).

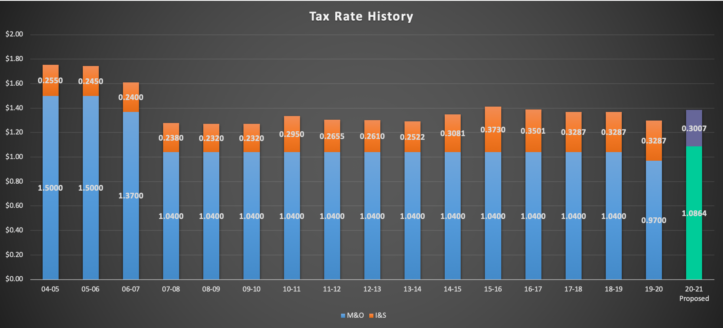

Arlington ISD’s Maintenance and Operations (M&O) tax rate has remained the same or declined in each of the past 15 years. The district has never held a VATRE (known as a TRE prior to 2019).

How much will the tax rate increase?

In this VATRE, scheduled for Nov. 3, 2020, the Arlington ISD will ask for approval to set the total tax rate at $1.3871 per $100 of assessed value, an increase of 8.84 cents.

Why call a VATRE?

There are several primary reasons the Arlington ISD has called for a VATRE:

1) Teacher Pay

Arlington ISD has lost ground in competitive market pay for teachers over the last several years. Competing districts with more revenue can effectively attract and retain quality educators through higher salaries. A VATRE would be used to increase teacher compensation.

2) Access additional state funding

The additional pennies of tax authorized through a VATRE are weighted in state funding formulas. The proposed tax rate increase would generate approximately $18 million in state aid to be used for teacher salaries and instructional programs.

3) Staff Pay

Like pay for teachers, Arlington ISD would use the VATRE to increase pay for support staff. This includes approximately 4,000 staff members who provide educational support services for students, drive buses, clean and maintain schools and provide security services.

Tax Impact

If the VATRE is approved by voters in November, the total tax rate would increase 8.84 cents. The new tax rate would cost the owner of an average home in Arlington, which is valued at $208,985 according to the Tarrant Appraisal District, an additional $162.70 annually, or $13.56 per month. Taxpayers over age 65 would incur no tax increase unless they make substantial improvements to their home.

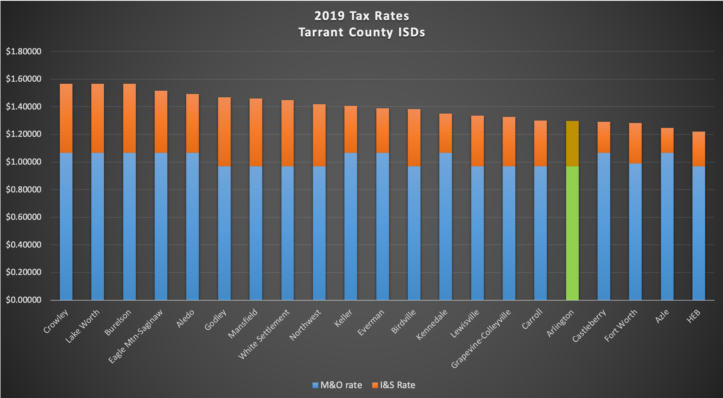

How Does the Current Tax Rate Compare to Other School Districts?

AISD’s current total tax rate ranks as 17th lowest among the 21 Tarrant County school districts. Only four other districts have a tax rate lower than AISD. Eleven Tarrant County school districts have already received voter approval to raise their M&O tax rates for salaries and operations.

Efficiency Audit

House Bill 3 (86th Texas Legislature) requires school districts to contract for an independent efficiency audit before holding a VATRE. An exemption from the efficiency audit requirement is automatically provided for a two-year period for school districts in an area declared a disaster by the Texas Governor. On March 13, 2020, Governor Greg Abbott declared a state of disaster for all counties in Texas due to the coronavirus pandemic. No school district is required to conduct an efficiency audit prior to conducting a VATRE for two years following the declaration. AISD chose to undergo an efficiency audit despite the exemption. The results of the audit are available here.

Financial Accountability Rating

Under the School FIRST system (Financial Integrity Rating System of Texas), the Texas Education Agency (TEA) assigns each school district a financial accountability rating based on a district’s overall performance on certain financial measurements, ratios and other indicators established by the Commissioner of Education.

The District received a School FIRST rating of “A - Superior” for 2019. The report is posted on the Financial Transparency page of the AISD website.

Frequently Asked Questions

Links

- VATRE Fact Sheet (Spanish)

- Notice of Voter-Approval Tax Rate Special Election

- Arlington ISD - Financial Transparency

- Campaign Finance Reports

- Certificate for Order and Order Calling Voter-Approval Tax Rate Election (ENGLISH)

- Certificate for Order and Order Calling Voter-Approval Tax Rate Election (SPANISH)

- Certificate for Order and Order Calling Voter-Approval Tax Rate Election (VIETNAMESE)

- Texas Comptroller - Tax Rate Calculation

In total, the VATRE, if approved, would give the Arlington ISD access to approximately $56 million in additional revenue. Of that total, about $18 million (or one-third) will come from an increase in state funds. Without passing a VATRE, the district would not receive the additional state funding.

The additional resources will be used to provide competitive teacher and staff compensation and instructional opportunities for students.

Almost 90% of our budget is comprised of salaries. Revenues from a VATRE would be spent almost entirely on salaries.

School districts are funded primarily from two sources: property taxes and state aid. However, rising property values do not equate to more money for schools. Instead, when property values increase, the State of Texas reduces the amount of money it sends the district on the Tier I portion of the tax rate. There is no adjustment in the state funding formulas for inflation.

If the VATRE is approved by voters in November, the total tax rate will increase by 8.84 cents. The new tax rate would cost the owner of an average home in Arlington, which is valued at $208,985 according to the Tarrant Appraisal District, an additional $162.70 annually, or $13.56 per month. Taxpayers over age 65 would incur no tax increase unless they make substantial improvements to their home.

Eleven of the 21 school districts in Tarrant County have already received voter approval through a VATRE to increase their tax rate, including Fort Worth, Burleson, Keller, Aledo and Azle. Other area school districts that have passed a VATRE include Dallas, Irving, Grand Prairie and Denton.

No. Bond money can only be used for facilities and assets, including facility construction and renovation, technology, school buses, equipment and property. Bond funds may not be used for employee compensation or day-to-day operations.

School district property taxes have two components: the Maintenance and Operations tax rate (M&O) and the Interest and Sinking tax rate (I&S). The VATRE would affect the M&O tax rate, which funds teacher and staff compensation and all school district operations. The I&S rate is strictly used to pay off bond debt and cannot be used for anything else.

The Arlington ISD’s Financial Futures Committee, comprised of citizens and Arlington ISD employees, recommended that the Board of Trustees consider a VATRE for each of the past three years. In addition, independent surveys conducted in 2019 and 2020 indicated the Arlington ISD community favored considering a VATRE.

House Bill 3 (passed by the 86th Texas Legislature) increased state funds to reduce school district tax rates and pay for several mandates including salary increases, full-day prekindergarten, dyslexia services and compensatory services for at-risk students. Most of the new money provided through HB 3 was for designated purposes. Little discretionary new money was provided. HB 3 resulted in different funding levels and created more variations in teacher compensation among districts than existed prior to passage of the bill. School districts that have already passed a VATRE gained more new revenue through HB 3 and are able to offer more competitive salaries for teachers than those districts that have not yet leveraged the additional state and local revenue resulting from a VATRE.

If the VATRE does not pass, AISD will not have access to as much funds to offer the competitive teacher salaries, staffing levels may have to be reduced and some instructional opportunities may have to be curtailed or not offered.

Information regarding AISD’s financial management can be found on the Financial Transparency page of the District’s website. Data posted at that site includes annual budget and audit reports, efficiency audit report and Schools FIRST financial accountability rating report.

Yes, and we do. We carefully prioritize our needs each year and look for opportunities to cut costs. We were able to reduce costs by $1.6 million this year (staff reductions and new contract for electricity supply). Our operating costs per student ($9,566) are less than our peer districts ($9,843) and less than the state average ($9,912).

Administrators typically get the same raises as teachers. AISD’s cost per student for administration ($174) is about one-half the state average ($322).